Dear Clients and Friends of Insight,

The tug-of-war between Wall Street “bears” and “bulls” continues as investors react to a wide range of economic results. If the day’s reports suggest a slowing in the economy, somewhat surprisingly, stocks have tended to rise. The thinking is that if the economy is slowing then the Federal Reserve will ease their restrictive monetary stance. This would allow interest rates to move down and help the economy and corporate earnings to continue growing modestly, characterized as a soft landing.

Correspondingly, if the news flow suggests a stronger economy, stocks have tended to fall. This is because inflationary pressures would increase, forcing the Federal Reserve to continue raising interest rates, potentially sending the economy into a recession. In other words, good news for the economy is bad news for investors.

As the year unfolded, the consensus view was that the economy was slowing down, though not so much as to result in a recession. Inflation was moderating, allowing for interest rates to eventually fall. The momentum was with the “bulls” as stock prices trended up.

This trend ended abruptly in late July. Suddenly, investors discovered that the economy was not softening, but rather was strengthening across many sectors. The expectations for growth in the economy and corporate earnings began to rise. Some analysts even raised their estimates for the 3rd quarter’s gross domestic product to an astounding 7% and lifted their targets for growth in next year’s earnings to nearly 12%! Thus, the “bears” pulled stock prices down in August and September as fears of rising inflation and interest rates resumed. As a result, many stocks now sit in negative territory for the year.

During this oscillation, a handful of stocks have risen enormously and continue to do so. They are from very large, dominant businesses that are all perceived to be major beneficiaries from upcoming and growing investments in generative artificial intelligence. These stocks have been dubbed “The Magnificent Seven” and now represent seven of the ten largest stocks in the world. Here they are with their year-to-date price change: Alphabet/Google (+49%), Amazon (+51%), Apple (+32%), Meta/Facebook (+149%), Microsoft (+32%), Nvidia (+198%) and Telsa (+103%).

This enthusiasm for what generative artificial intelligence holds for the Magnificent Seven’s future has already become euphoric. Here is an incredible statistic to help put this into perspective. The combined market value of these seven stocks now exceeds $10 trillion. If together they were a country’s stock market, they would be the third largest market in the world behind the U.S. and China. And, nearly twice as large as Japan, currently the world’s third largest market.

From our decades of market experience this tells us to be cautious; and we are reminded of frequent references to research regarding the future performance of the ten largest global stocks by market value, after they have achieved this Top Ten status. In nearly all cases these excessively valued companies underperformed the broad stock market in subsequent years. Their market values fell in relation to other companies when the overly optimistic results did not materialize. This is to be expected when we operate in a very competitive and innovative global economy, coupled with government regulation.

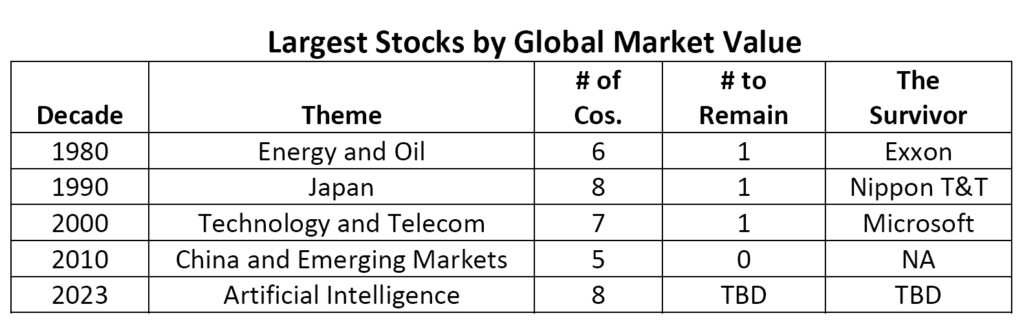

Here we present the favorite themes for the start of each of the last five decades. We show the number of companies among the world’s ten largest that fell under the theme, as well as the company that remained among the top ten a decade later, if there was one.

We counsel conservative investors to not let enthusiasm for the future over-influence their investment discipline. Ours is rooted in demonstrated financial results and a careful eye on stock valuations. Though we are pulling with the “bulls” in this tug-of-war, we are cognizant of the increasing risks to the economy, and mindful that Insight client portfolios continue to have exposure to some of these expensive stocks.

And yes, I really did generate this letter myself.