Dear Clients and Friends of Insight,

The Federal Reserve a few weeks ago affirmed their commitment to continue their restrictive policies aimed toward taming inflation, and Chairman Powell warned that the economy may suffer as a result. This alert, after they have already aggressively raised their target interest rate four times for a total of 3.00% this year, took many investors by surprise. Somewhat complacent during the summer, these investors took the Fed’s preemptive warning seriously and sent interest rates up dramatically. By example, 10-year U.S. Treasury bonds, with yields of about 1.5% to start the year, now sit at about 4%! This caused an abrupt reversal to this summer’s stock and bond rally, sending many prices back into bear market territory.

Third quarter stock returns were negative, but not by much. The S&P 500 retraced all of this summer’s gains, declining by 5%. This drop has brought the index to a loss of 24% for the year. For bond owners, the quarter was even more challenging. The Bloomberg Aggregate Bond Index fell nearly 5% for the quarter and has now declined over 14% for the year. Thus, portfolios with a balanced allocation of stocks and bonds have experienced negative returns from both buckets, which rarely occurs, and has made the year’s declines more painful. Usually, bond returns are positive when stock returns are negative, helping to moderate a portfolio’s total loss.

Investors have felt the impact of this bear market in stocks and bonds more than usual. To quantify, a conventional balanced portfolio of 60% stocks and 40% bonds suffered a decline this year of 20%, as measured by the 24% decline in the S&P 500 and the 14% decline in the Bloomberg Aggregate Bond Index. By contrast, if bonds had instead appreciated by 5% this year, more in line with their historical average, this conventional portfolio’s decline for the year would have only been 12%. A tough year for all investors, though conservative investors fared much better, while aggressive investors suffered much worse declines. A bright spot for Insight clients is that their balanced portfolios performed considerably better, in the range of negative 14% – 16%, as both equity and fixed-income buckets declined considerably less than these respective benchmarks.

Some investors and strategists are critical of the Federal Reserve’s determination to halt inflation. They believe that more harm will come to our economy if the Fed’s policies pull us into recession than if we endure several years of elevated inflation. Hence, their outlook is bearish. Other investors, such as short-term traders who are eager to profit from the current negative sentiment, are fueling the downturn.

We believe this thinking is short-sighted and wrong. The long-run cost to the economy from inflation is quite severe as it destroys our currency’s purchasing power. Here is some history to make the point. After experiencing the rampant inflation of the 1970’s, the Federal Reserve finally raised interest rates aggressively in early 1981. In hindsight, these policy decisions were considered successful, yet inflation remained stubbornly too high throughout the 1980s. It averaged over 5% per year! This decimated the purchasing power of the dollar, which lost 37% of its value in the decade between 1980 and 1990! By the way, stocks managed to advance

considerably during the decade as the economy continued to grow and expectations for future inflation continued to moderate over time.

This potential for the erosion of purchasing power due to inflation should be of utmost concern for long-term investors and consumers alike. Yet instead of being pleased with the Federal Reserve’s position, market participants have reacted to the negative shorter-term consequences of this restrictive policy stance. Stock valuations have compressed considerably since earlier in the year when the S&P 500’s price-to-earnings ratio was at an elevated 25x. Now the S&P 500 is selling for 15x earnings, quite a severe contraction in value, but much more reasonable and in line with historical averages.

Ironically, the expectations for inflation five years from now are quite moderate at about 2%. And, large U.S. corporations continue to grow their revenue and profits (up 12% and 9% respectively in the most recent quarter). Though business momentum has slowed, healthy profits continue to accrue to well established firms. Yet, some investors worry that we are in the early stages of a multi-year bear market as higher interest rates ignite a series of problems for the economy’s financial health.

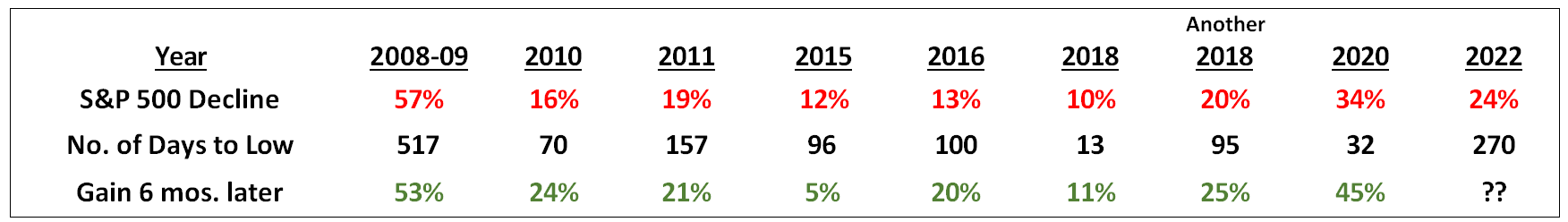

It’s natural to feel that the many challenges of today’s economy are unique and present a serious hazard to future investment success. This feeling of uneasiness that occurs more regularly than we remember does eventually pass. As the table below illustrates, there have been many opportunities for investors to overreact to short-term uncertainties – much to their detriment.

Here we show statistics for the significant stock market drawdowns of 10% or more in the S&P 500 since the financial crises of 2008-2009. Surprisingly, there have now been 9 such occurrences.

Patient investors who checked their emotions were well rewarded for their steadiness. The S&P 500’s current decline of 24% over the last 270 days is quite substantial, and we believe is in line with today’s uncertainties.

As the year closes out, we expect an increasing number of investors to become more bullish as they evaluate the positive impact from the Fed’s policies as inflation moderates and the economy’s durability becomes more evident. We still lean bullish while our portfolio strategy remains conservative. For stocks, we are looking to add some fallen angels with abundant cash flow while selling some weaker positions to realize tax losses. For bonds, we are beginning to find value and anticipate committing funds to high-quality issuers in the intermediate-term municipal and corporate sectors.