Dear Clients and Friends of Insight,

Here we are mid-way through the year and our economy has so far avoided falling into the MUCH-ANTICIPATED recession, which has generally been expected now for over a year. Furthermore, much of the recent news flow indicates economic trends are now stronger than previously expected (i.e., labor, housing, and consumer markets); and, corporate profits have remained quite resilient, despite many global challenges. These trends are convincing more and more market prognosticators to raise their economic forecasts from “gloom” to “resume”, as in resuming a continuation of modest but uneven growth across our diverse economy. Recent market sentiment confirms that the outlook for stocks has improved as stock indexes are now in positive territory for the year.

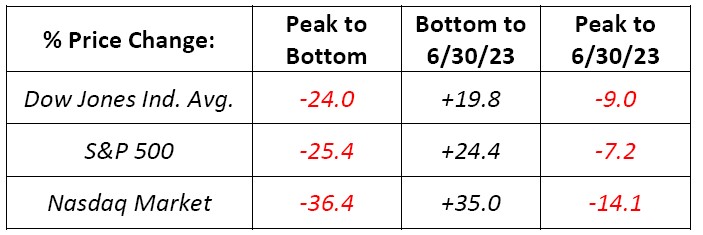

Regardless of whether the recession will take hold, stock investors did experience a devastating bear market that began in early 2022 when stock indexes reversed course (as inflation and interest rates rose) to begin their long decline throughout that year. And, though stock indexes have now advanced well above their lows from last fall, there are many investors who stubbornly believe that the bear market in stocks persists, and that stock prices will head down once again. As the table also shows, even after posting these strong gains off their lows, stock prices are still well below their prior peaks.

This poses a serious dilemma for serious investors. To put it simply, if the economy continues to grow, corporate earnings should grow as well. Under this scenario, stock prices have a good chance of continuing their advance, and we should be bullish. However, if the economy does eventually contract and cause all manner of problems, stock prices would easily follow suit and resume their bearish trend. This could even lead to more carnage than last year. Of course, there are a range of possible outcomes, but these two opposing views seem to mark the boundaries of the current debate.

These uncertainties force each investor to evaluate the risks and rewards of these outcomes in relation to their own goals and objectives. Recall, though, that stock prices are a function of the aggregate of investors’ future expectations, which is always hard to discern. Generally, better-than-expected results will lead to advancing stock prices, while results that lag expectations will lead to declining stock prices.

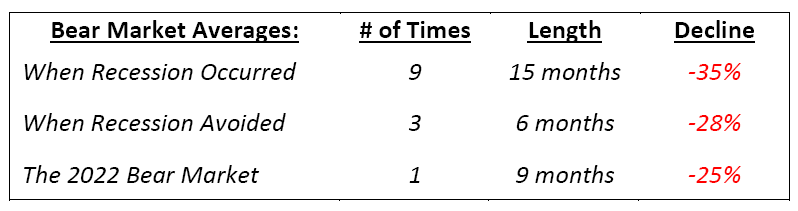

Considering this challenge of balancing risk and reward, we thought it would be useful to review some historical statistics on the relationship between economic recessions and stock prices. This is particularly timely since many upcoming economic reports will likely diverge from current expectations, further confusing the economy’s outlook. Since 1945 there have been 12 bear markets, defined as a price decline of 20% or greater in the S&P 500 Index. In each case, investors expected that an economic recession was imminent. This consensus opinion proved correct for 9 of the 12 periods, but the economy surprised the consensus and continued its upward growth on three occasions. Those were in 1962, 1966, and 1987. Notice that when a recession did materialize, the bear markets tended to last much longer and decline further than when the recession failed to arrive. We’ll soon find out what happens with this cycle.

Whether the recent market gains are the beginning of a new, sustainable bull market or just a jubilant rally within a continuing bear market, it is important to remember that we are investing for the long term – a common and critical trait of most successful investors. They do not time the market, moving in and out of stocks in anticipation of major market moves. Instead, they carefully select investments which they believe can uphold much of their value through these inevitable market declines. Those carefully selected investments are most likely to be the stocks of high-quality businesses with the following characteristics: sound finances, a history of growth in both sales and earnings, consistently positive returns on equity and assets, and meaningful and growing dividend payments to shareholders.

The recent results for the companies in your Insight portfolio, which we closely monitor each quarter, continue to trend positively for these characteristics. As Warren Buffet wrote in his 2021 shareholder letter, “don’t bet against America”. We agree.

Wishing you a safe and happy 4th of July.