Dear Clients and Friends of Insight,

The news turned continually more negative for the economy as the second quarter unfolded. Whether it was more persistent inflation, higher interest rates, rising inventories, or falling consumer and business confidence, market participants viewed the data points as valid indicators that our economy might soon slip into recession. Furthermore, the economy could ultimately endure an extended period of stagflation, which denotes elevated inflation, higher interest rates accompanied with anemic growth. Since investors base their decisions on future expectations, stock and bond markets continued their declines throughout the second quarter with most market indexes having now tumbled into “official” bear market territory.

Before I address the health of our economy and the markets, let’s briefly revisit our discussion on inflation (begun back in April 2021) and why it presents such a material challenge to investors.

Recall that stocks and bonds are traditionally valued for the aggregation of future income they are likely to provide their investors. Since inflation diminishes the purchasing power of this future income, the securities are worth less to investors now, and their valuations contract. Thus, the higher that inflation trends, the lower that stock and bond prices might trend.

It gets worse. In response to this diminished value of income, interest rates rise to levels that will now compensate bond investors with enough additional income to offset this loss. Higher interest rates then cause consumption to slow as financing becomes more expensive. These higher interest rates also raise the cost of capital, which is the key hurdle rate for evaluating the profitability of future investments. A higher cost of capital tends to suppress investment activity, stifling the economy’s potential and further weighing down future growth in sales and income. Thus, the higher that inflation trends, the even lower that stock and bond prices might trend.

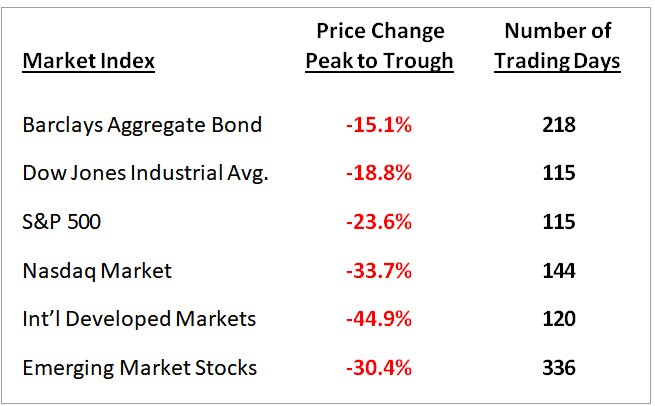

As we know, most stock and bond prices have fallen considerably from their earlier highs in response to these growing risks. However, what is less obvious is the disparity in performance and the depth of loss among certain investment categories. Investors who allocated to the riskiest and more speculative investments

experienced true carnage. Cryptocurrencies, special purpose acquisition companies, IPOs, emerging market debt, and certain venture capital and hedge funds experienced severe losses of 50% to 100%. Meanwhile, the less severe but meaningful price declines for more traditional stock and bond investments (shown here) have hurt investors as well and brought their valuation metrics down to historically reasonable levels. Together, these losses have cost investors trillions and trillions in lost capital! Perhaps that is enough pain to compensate for the damage that higher levels of inflation will inflict on our economy, and markets will soon find their footing.

Whether our economy officially enters recession or not, growth has slowed from the 4.6% growth in 2021 to the current consensus of 2.8% for 2022. Though this slowdown was expected, economic signals regarding the health of the economy are now even harder to interpret. Yet, we believe the economy remains resilient and could surprise the pessimistic crowd with continued modest, but uneven, growth over the coming years.

After a closer evaluation of the fundamentals, some bright spots emerged to support our confidence.

- Forecasts for the year’s global growth remain positive at about 3%

- The index of leading economic indicators continues to point to an advancing U.S. economy

- Consumers continue to spend while savings balances sit comfortably above normal

- Corporate results exceeded expectations, as Q1 earnings advanced 9% year over year

- Analysts expect earnings to advance further, supported by record-high profit margins

- Dividends are still growing for the best capitalized companies, some at double-digit rates

- The financial system is extremely healthy as demonstrated by the results of June’s bank stress tests, which is very reassuring to us

Though our clients’ portfolio values are down for the year, they have weathered this current storm extremely well. While the outlook continues to be foggy, we remain committed to our stock exposures and believe the current environment provides attractive opportunities to invest in high- quality businesses with bright and profitable futures. Where suitable, we will continue to add to our client’s stock holdings.