Dear Clients and Friends of Insight,

Welcome to the New Year! We wish all of you a healthy, peaceful and prosperous 2024. All of us at Insight are so thankful for our relationship with you and the confidence and trust you place in us. We value this relationship very much.

Last year was another perplexing year for investors to navigate. Interest rates rose dramatically, expectations for corporate earnings contracted, and consumer sentiment languished throughout most of the year. Investors were consumed by their uncertainty regarding the health and direction of the economy. It was uncomfortable for most of us, but especially for those less-experienced investors who have never lived through this type of macroeconomic gyration. The most popular and frequently asked question from 2023 was “Are these higher interest rates slowing the economy enough to tip us into a recession, or, is the economy’s growth just pausing, likely to regain its strength soon, as we adapt to this new paradigm of higher interest rates?” Despite all this ambiguity, gladly both stock and bond returns were ultimately positive for the year.

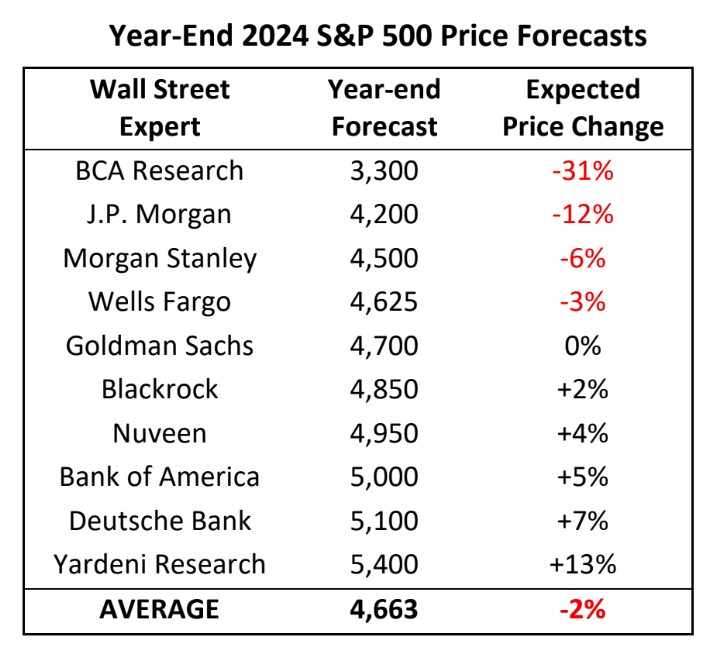

Of course, differing opinions regarding the outcome of this debate will lead to differing opinions on the future of stock prices. Further, the wider the differences in opinion become, the wider the range of market outcomes investors should expect. This is the time of year when we all make predictions for what is ahead. Wall Street bankers and investment strategists do the same with their year-end market forecasts. They are just a bit competitive though and like to promote themselves. We thought you would appreciate seeing their predictions for 2024 stacked up against

each other.

Here we show ten prominent Wall Street firms along with their predictions for the S&P 500 Index price change for the year 2024. For reference, the

S&P 500 traded at 4,770 to end last year, and the table is sorted from the worst expected return to the best.

Two observations stand out: 1) there is a wide range of outcomes, which seems consistent with this grand debate on the economy; and 2)

these forecasts lean “bearish”, which seems inconsistent with the recent “bullish” sentiment that has driven many stock indexes to near all-time

highs. Here is a sampling of their cautious commentary: “we are past the peak;” “prepare for recession” and “there’s no room for error.”

Undoubtedly, each of these experts will change their stories as the year unfolds. We’ll find out this coming December which one of them was closest to the mark.

Considerable research has been conducted on market forecasting that should caution investors from relying too heavily on an expert’s opinion. I recently reviewed one such study titled “Do Financial Gurus Produce Reliable Forecasts?” This study focused on forecasts for the price of the S&P 500. The authors’ elemental finding was that 84% of the forecasters they analyzed had an accuracy rate below 60%, while only 16% had an accuracy rate above 60%! This finding should not surprise us since it is commonly agreed that you cannot successfully predict the markets. Yet, these numbers seem shocking.

This study leads me to counsel conservative investors to build their long-term investment program on time-tested investment principles that do not depend on the short-term sentiment of market participants. These investors have the benefit of being able to adhere to their long-term plans without needing to accurately predict the upcoming year’s market moves, even when the future feels very uncertain.

A few words about last year’s market returns. Unlike 2022, both stocks and bonds chalked up positive returns in 2023. Insight’s client portfolios advanced at double-digit rates as a result. In hindsight, it was once again quite a rewarding year for our clients!

We look forward to our individual conversations with you throughout the year. I am sure there will be plenty of perplexing issues to discuss.