Dear Clients and Friends of Insight,

The year 2020 has been like no other and there is certain to be another chapter or two written before it is in the books. A common theme for the year has been the economy which started out as the longest expansion on record, followed abruptly by the shortest recession ever, and then burst into the strongest recovery in history. Allow us to revisit how we have arrived at our current state, our counsel to you along the way, and where we think we are headed.

Throughout the economic expansion which ended in March, investors were increasingly paranoid that every negative headline signaled the onset of recession and the beginning of the next bear market. Our counsel over those years, formulated on our sincere belief in the strength and resilience of the U.S. economy, was to remain fully invested in U.S. stocks per each client’s long- term objectives. Clients benefited considerably from this position, especially in comparison to the returns from other investment choices.

In our January letter we shared our enthusiasm for the upcoming decade of discovery and innovation that would brighten our lives both personally and financially. We showed that the dominant titans of industry have been a good reflection of how our economy has evolved over time. We further observed that these companies rarely maintain their elite status across decades because as our economy continually transforms, new leaders emerge to displace the old. Thus, the stocks of these titans are not always the best opportunities for investors, and sometimes can even be quite risky.

Shortly thereafter, we were confronted with the global health pandemic and attendant economic crisis. Around the world, financial markets crashed, investors panicked, economies plummeted into recession, and governments hastily implemented aggressive policy responses. In our April letter, while uncertainty prevailed and stock prices hovered near their lows, we expressed our conviction that when the fog cleared, investors would once again appreciate the underlying value of American businesses, and this would set the stage “for higher stock prices in the future. Perhaps much higher.”

Thankfully, the rebound happened much more quickly than we expected. As the second quarter ended, business conditions had rapidly improved and stock market indexes retraced much of their lost value. Yet as strong as this economic rebound was, it was not benefitting all businesses equally. Some sectors of the economy were experiencing rapid growth while others remained seriously challenged. This led us to share our concern in our July letter about the wide dispersion that was developing between the stock prices of companies perceived to benefit the most from the “post-Covid” economy and the rest of the stock market. This was evidenced by the wide gap in the year-to-date performance through June of the Nasdaq Composite Index (positive 12%) and the Dow Jones Industrial Average (negative 10%).

The general business conditions and surrounding uncertainty remain much the same now as in July, yet enthusiasm for these high-flying stocks with the rosiest of outlooks has mushroomed over the summer. Investors piled into these stocks even more, as their prices zipped to new highs and with it the Nasdaq Composite, which at its peak in early September was up 34% for the year! As for the stodgy Dow, it continued to grind higher and barely broke a sweat, up 2% at its peak. Insight clients have had a similar experience. We are reminded of the classic fable The Tortoise and the Hare.

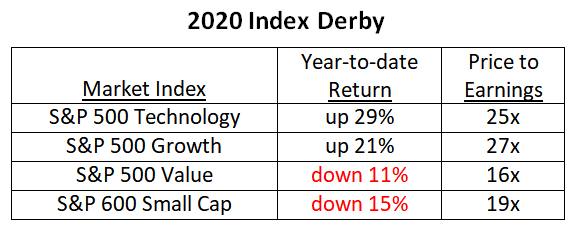

This market behavior caused conservative investors to become increasingly uneasy. The outsized market gains are concentrated in just a few sectors and companies. See our accompanying table. Many of these companies now have extremely rich valuation levels which are drawing historical comparisons to the dot-com era in the late 1990’s. Recall the Nasdaq Composite’s painful multi-year decline of 79% from its peak and the 15 long years it took to claw back to a new high. Amazingly, the Nasdaq market capitalization has now grown to exceed the entire MSCI World Index (excluding the U.S). That is nearly double its share back in 1999!

We will eventually learn whether our concern for the extreme risk in these market high-flyers is justified. There are signs that since the peak in early September investors are becoming more cautious about these high valuations. We are hopeful that this is a sign that more investors are searching for value by rotating into the less popular, less expensive stocks with broader sector and company exposures. This outcome would be a healthy improvement to the market’s current dynamics.

In the meantime, our economy’s recovery and longer-term transformation will continue regardless of the election outcome. We are perhaps more confident today in its long-term strength than before the pandemic. We have witnessed many companies quickly adapt to meet the unique challenges of each of their businesses. It is quite inspiring and offers investors a glimpse of possible rewards to those employing a fundamentally sound investment process.

Please enjoy a wonderful upcoming holiday with family and friends as we all navigate through these health challenges, even though Disneyland remains closed. We very much value our relationship with you.

INSIGHT INVESTMENT COUNSEL