Dear Clients and Friends of Insight,

The investment era following the financial crisis has been overwhelmingly driven by the pronouncements and policies of the Federal Reserve Board and other central banks around the globe. “Don’t fight the Fed” is a bell-weather investment tenet which states that stocks perform well when Fed policy is accommodating to economic growth, and they struggle when Fed policy is restrictive toward economic growth. If investors followed this advice during this expansion, they were guided to merrily participate in this “the longest of U.S. bull markets”. Hence, as the Fed steadfastly raised their benchmark interest rate over the last two years in their effort to guide the economy onward, investors became increasingly more anxious that these policies may have become too tight.

Stocks sold off considerably (again) in May when investors worried that the Fed’s rate hikes had finally suppressed the economy’s progress enough to hurry us into the next recession. Stocks snapped back (again) to set new highs in June when the Fed announced their willingness to cut interest rates, if needed, to sustain economic growth. It is not clear to investors and market pundits whether, at this point, the Federal Reserve’s policies should be restrictive or expansionary. What is clear is that the economy following the financial crisis has been difficult to interpret with confidence, and in some cases, has even challenged accepted economic theory. Widely followed statistics and indicators have lacked consistency from quarter to quarter, amongst major economic sectors, or across the globe’s major regions. These signals have shifted constantly between hot and cold, with lots of lukewarm readings in between.

We have consistently counseled clients with our belief that the U.S. economy has had the underlying strength to support continued, healthy corporate profit growth. This growth in earnings is the fundamental reason for the market’s persistent price gains. Remember, historically stock prices have closely tracked earnings changes over time. Like most accomplished investors, we believe this relationship will continue, and that the level of corporate earnings will be the key determinant for stock prices in the future. The Fed’s judgement on the current health of our economy will significantly influence the level of corporate earnings for the next several years.

Most investors concur that economic expansions do not have a term limit. Rather, they end when there are built-up excesses in the economy or disruptive public policy actions. Yet after such a long expansion, even the most optimistic investors are concerned that this underlying strength cannot continue, and corporate earnings will recede. I recently attended an investor conference sponsored by the Chartered Financial Analyst Institute. I participated with many hundreds of investors and listened to dozens of accomplished speakers. The general mood was nervous and dubious. To paraphrase, the most common sentiment I heard was “I’m not saying I’m bearish, but this bull market is old and can’t last forever”.

Let’s take a close look again at what has occurred since the lows following the financial crisis in this “the longest of U.S. bull markets”. Recall that the S&P 500 Index suffered severe price declines during this crisis, finally bottoming at 677 in March of 2009. Since then, the S&P 500 has advanced to a level of about 2,900. An impressive gain of some 325%! Importantly, to support this sustained price advance, the underlying earnings for these companies also grew prominently

—some 275% from the post-recession low of about $45. These are solid achievements.

We find very different results when we contrast these same comparisons, measured instead from when the U.S. economy peaked nearly 12 years ago. The S&P 500’s then all-time high reached in late 2007 was 1,565. The advance to today’s level of about 2,900 equates to a more modest gain of about 85%. Meanwhile, the underlying earnings of the S&P 500 are expected to reach about

$170 this year, for a similarly modest gain of about 88% from their prior peak of about $90. These results are sub-par given the length of time it took for these gains to be achieved.

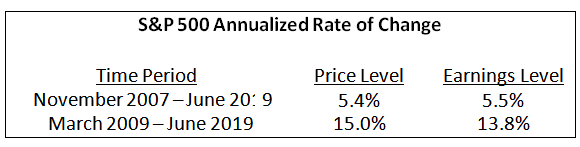

We believe the economy and stock market should be evaluated by their measured, absolute achievements, not by their chronological age. The accompanying table illustrates how different our conclusions are

when viewing results from a different perspective. It shows the achievements we just discussed as annualized rates of change, not by absolute percent changes.

We expect investors to continue worrying, especially if this economy’s health, as interpreted by the routinely reported statistics, remains ambiguous. Market indexes, and investors who invest indiscriminately in the popular index products, may experience disappointing results. Their returns will more likely move in unison with other investors’ interpretation of Federal Reserve Board policies and pronouncements. We believe that there remains compelling reward for investors who own carefully chosen individual stocks. These companies have our customary qualities of financial soundness, reasonable valuations, and the ability to strengthen their earning power in the forthcoming economic environment.

INSIGHT INVESTMENT COUNSEL