Dear Clients and Friends of Insight,

There has been much dramatic news around the globe since we last wrote to you in April, but contrary to the reaction in foreign bond and stock markets, the U.S. markets have only been marginally bothered by it. The rise in interest rates slowed considerably in the second quarter and was less than many had feared. Rates increased just slightly. As a result, most government and corporate bond indexes were flat, while municipals edged up a bit. Turning to stock markets, they were calm considering the world’s current events. Most broad indexes traded in a slightly upward trend, returning them to positive territory for the year. This is a sharp contrast to the first quarter, when stocks were highly sensitive to global political and economic events. Recall that the S&P 500 rose an ecstatic 6% in January, followed by an abrupt 10% correction in February, and closed the first quarter in negative territory.

Where does that leave stock investors? The fundamental economic backdrop remains strong, consumers and businesses are very confident, and sales and profits for most companies are growing nicely. Market gyrations will continue, though, and will no doubt capture the interest and emotion of investors. However, we believe that future economic and business reports will be

well-received by the investment community and expect that steadfast investors will be rewarded for owning common stocks during these turbulent political times.

Meanwhile, recall that the reward for owning common stocks comes from two sources. The most easily discerned and most often calculated is a stock’s current price, in relation to its purchase price. As experienced stock investors know firsthand, this reward can take years to materialize, even while economic and financial conditions are positive. The other, less obvious, reward is the cash returned to shareowners from the company’s profit. This comes in two forms, both of which are decisions of the board of directors: dividends and stock buybacks.

Dividends are paid directly to shareholders, usually each quarter. These payouts grow over time as a company’s profits grow, hence, your return on investment grows as well. Stock buybacks are direct purchases by a company of its own stock paid for with its retained earnings. Buybacks reduce the number of outstanding shares, which leaves the remaining shareholders owning a larger portion of the company. These buybacks occur intermittently, if at all, and vary in amounts based upon a company’s financial results and its board’s outlook. In many cases, these can have a meaningful impact for shareowners. For example, the effect of a 20% reduction in a company’s outstanding shares is to increase its current earnings per share by over 25%! Often, the higher earnings per share helps advance the company’s stock price as well.

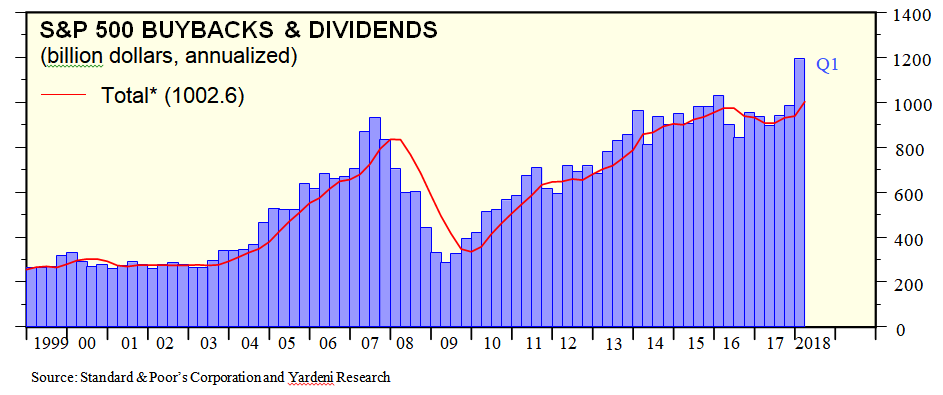

Knowing, over time, that the cash returned to shareowners provides a meaningful and growing return is reassuring. Furthermore, knowing the significance of these returns can be instructive and help guide our investment behavior, especially during uncertain markets. Yardeni Research created this historical graph of stock buybacks and dividends for the S&P 500 to show just how

meaningful these flows have been. Through the first quarter, with help from the recent tax legislation, they amounted to an astounding $1 trillion. They also found that, at the S&P 500’s current level, the return paid in cash for dividends is 1.9%, and the return paid for stock buybacks is 2.6%, for a total of 4.5%. Consider, too, that if your investment was made when the S&P 500 was 20% lower than today’s level, the return on your investment would be higher. In fact, the cash returns would be 2.4% from dividends and 3.2% from stock buybacks, totaling 5.6%!

As we routinely remind you, Insight follows a disciplined and rigorous stock selection process. This commonly leads us to invest in companies with superior strength and strong cash flows. These attributes can lead to earning materially higher returns from owning common stocks. These companies tend to pay higher dividends than average, and exercise stock buyback programs with some regularity. Thus, investing in them leads us to expect to earn even higher cash returns than the S&P 500. Given the low interest rates and inflation we have today, we think these payouts are very compelling.

INSIGHT INVESTMENT COUNSEL