Dear Clients and Friends of Insight,

In our April letter, we discussed implications of the Federal Reserve’s appetite to continue raising the Federal Funds rate throughout the year, which they increased again a few weeks ago. There have now been four rate increases since December 2015. We proposed that just because short- term rates were headed higher, not all bonds would see the same impact on their interest rates, and in some cases, their interest rates could even decline. Additionally, we suggested that stock prices should continue to move higher for many companies as earnings continue to advance with a growing global economy.

So far this year the Fed has increased their target rate from 0.75% to 1.25%, with indications that they will increase it again before year end. Meanwhile, the interest rate for the 10-year Treasury bond began the year at around 2.4% and now sits lower at around 2.1%. Likewise, the 30-year Treasury bond has moved down from about 3.0% to 2.7%. This continues the back-and-forth pattern for interest rates that has persisted for several years. Longer-term interest rates are primarily influenced by the strength in the economy and inflation expectations. As we are all too aware, our economy has oscillated between no growth and low growth for many years. We have also experienced low inflation due to lower commodity prices, technology innovation and the effect of an aging population on consumption. These factors are keeping expectations for future inflation low as well, and that is not likely to change soon. As such, we expect interest rates to continue to be range bound until inflationary pressures become more evident due to a stronger economy that is coupled with higher wages.

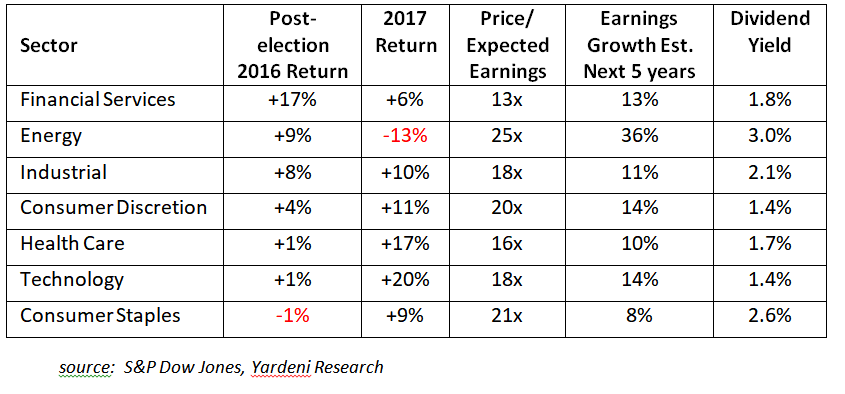

Switching to stocks, although they are not racing upward like they did in the first quarter, many have continued to rise in the latest quarter, sending stock indexes to record highs. These new highs have been fueled by the double-digit earnings growth reported by many companies. We are pleased with this positive performance, however not all stocks are performing similarly. A closer look at the S&P 500’s major economic sectors shows some dramatic diversions. Recall that following the election there was great enthusiasm for faster economic growth resulting from President Trump’s pro-growth policy rhetoric. Stocks in the financial, industrial and energy sectors were expected to benefit

the most and turned in the best performance to end the year. But as 2017 has unfolded, we’ve seen an almost complete reversal of fortunes as investors are realizing that policy and legislative changes will be difficult to achieve, and optimism wanes.

It should come as no surprise that investor sentiment can change dramatically in such a short period of time – it has happened with regularity these last few years. We know, though, that over longer time periods the returns achieved from stocks are a combination of dividend income, the growth in earnings, and the change to the valuation investors place on those earnings (the price- to-earnings ratio or P/E). With that in mind, if the next five years of earnings growth comes close to that expected in the above table, then stocks should still deliver meaningful returns, even though they are selling near all-time highs. This could be even more likely if investors are mindful of the P/E ratio they are willing to pay.

Now to share a few observations from Barron’s magazine’s mid-year “Big Money Poll” of professional investors. Keep in mind that investor expectations are frequently off the mark.

- 65% expect GDP to grow more than 2.5% over the next 12 months

- 94% expect corporate profits to increase over the next 12 months

- 54% expect inflation to remain under 2% one year from now

- 76% believe the 10-year Treasury bond will yield more than 2.5% one year from now

- 44% believe stocks are overvalued while 38% expect P/E ratios to contract

- 48% believe stocks are fairly valued while 43% expect P/E ratios will stay the same

- 9% believe stocks are undervalued while 10% expect P/E ratios to expand

- 51% are bullish on stocks over the next 18 months, compared to 38% last year

- 47% think changes in fiscal policy are likely to drive stock prices higher

- 45% think U.S. political turmoil is the biggest threat to the stock market

We will find out soon enough which of these expectations are more accurate. Until then, we wish you a wonderful summer. It is sure to be interesting.

INSIGHT INVESTMENT COUNSEL