Dear Clients and Friends of Insight,

Once again unexpected news, this time from Great Britain and the European Union, has shocked the investment community and stirred investor anxiety. Global markets for stocks, bonds, currencies and commodities have had adverse reactions and become more volatile. This serves as a good reminder of the need to manage risk in client portfolios. A portfolio’s asset allocation – the mix of stocks, bonds and cash – is considered one of the fundamental indicators of, and tools for, managing that risk.

We have discussed with many of you over the last year your portfolio’s asset allocation. Our goal has been to identify the appropriate mix of these assets for you, so that your desire to see your portfolio grow over time is balanced with your tolerance for risk of loss and your income requirements. This on- going effort of setting the right balance is potentially the most important determinant of your long-term success as an investor. Ironically, though, this decision has often been resolved by applying a simplistic formula to determine the “right” percentage of stocks for you, such as subtracting your age from 100.

Thus, historical wisdom suggests that as you age you should lower your allocation to stocks, since they have traditionally been the more risky asset.

We are living in unusual times and a simple formula is not a wise method, particularly when we are striving to both identify your appropriate long-term asset allocation target (5 years or more), while also being responsive to near-term tactical decisions (1 year or less) for your portfolio. A sensible starting point for this exercise of balancing your growth, risk and income needs is a discussion of interest rates and their impact on portfolio decisions.

Interest rates are important to investors for many reasons. Here are a few of the most important…

- they influence the current return you receive from bond coupon payments

- they set a hurdle rate for an acceptable return on investment from the capital allocation decisions of businesses

- they establish the competitive landscape for the various returns from other investments, whether those investments be in stocks, bonds, cash or real estate

- they help determine the “current fair value” of various assets due to the mechanism of discounting future cash flows

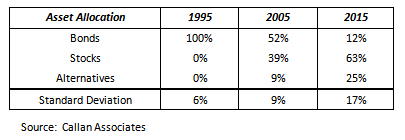

A simple example should demonstrate how the level of interest rates impacts a portfolio’s growth, risk and income attributes. This table shows for various years the asset allocation needed in order to earn a 7.5% target return. It is derived from the prevailing interest rates during each year, and the long-term

expected returns for various asset classes. In 1995, the target return could be achieved by investing 100% of your portfolio in bonds. However, because interest rates were lower in 2005, and even lower in 2015, investors needed to increase

their allocation to stocks and alternative assets to achieve their 7.5% target. This increased the portfolio’s risk, and lowered the current income available for distribution or reinvestment – consequences that are detrimental to an investor’s well-being. Your choices are to accept higher levels of risk to maintain returns or lower your return expectations.

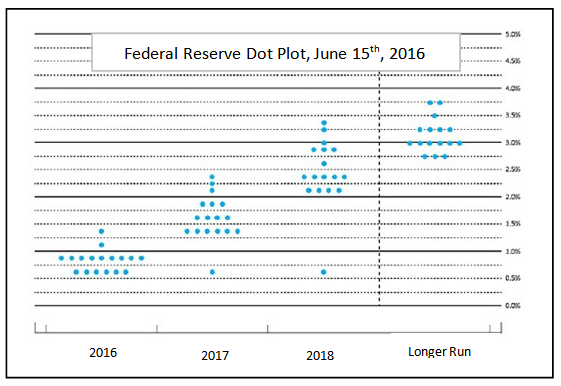

For quite some time interest rates around the globe have been extremely low, and are now even negative in many countries! Although the Federal Reserve has indicated that our interest rates will be on an upward trajectory for the next several years, as illustrated by the accompanying “Dot Plot”, we believe interest rates are likely to remain low for some time. This assessment is based on a number of reasons, which include:

- the prospects for low global growth for the foreseeable future

- modest inflation and commodity price pressure

- slack labor markets with stagnant wage growth

- large sovereign debt balances

- continued political dislocation and military disruption around regions of the world

The markets are providing investors with many reasons to feel unsettled and prompting a desire to increase their portfolio’s allocation to bonds. We believe that action will prove counterproductive to each of the goals of growth, risk management and current income. Increasing your allocation to bonds will:

- lower your current income because bonds are yielding less than stocks

- tempt you to stretch for yield by investing in riskier fixed-income assets such as junk bonds and emerging market debt

- provide less opportunity for growth in income because bond coupon payments are fixed

- increase your risk from inflation, diminishing your future purchasing power

We advocate that, for most clients, now is not the time to increase a portfolio’s allocation to bonds. Instead, the prudent decision is to maintain your current allocation with a discipline of owning predominantly high-quality stocks that pay substantial dividends with the opportunity for growth, complemented with owning high-quality bonds that have minimal credit risk. While always maintaining proper diversification across industries, sectors and issuers.

This strategy has been very beneficial to client portfolio results this year and we expect it to continue to provide similar benefits during the uncertain markets that we will likely encounter.

INSIGHT INVESTMENT COUNSEL