Dear Clients and Friends of Insight,

The year 2020 has now come to an end, but the impact from the days of 2020 will likely remain with us well into the future. For most of us, the pandemic inconveniently put our lives on hold. Many people, though, were far less fortunate. Their lives were upended or worse. Yet some people prospered from the opportunities that arose from the dislocations caused by this “virus crisis”. The same can be said for businesses.

Here at Insight, we were fortunate. Our team stayed healthy and productive. We remained committed to our culture of superior client care. We actively communicated with clients throughout the year, especially during the most uncertain days. We delivered reliable service while operating in a very challenging environment; other businesses struggled just to perform their basic services. Portfolio returns were strong, particularly over these last several months. Amazingly, the year’s results generally exceeded our clients’ long-term goals, despite the frightening journey. Thankfully, our business grew by over 10%. We were referred to a few new clients, and we gained additional funds to manage from current clients.

We are hopeful that this “virus crisis” is nearing its end. Clouds of uncertainty continue to lift, and rational thinking is taking hold. Investors have become more confident in their longer-term assessments of our post-crisis world. We are humble, though, and recognize that the future is always uncertain, and many stocks are trading at all-time highs. Recall that our October letter expressed concern that the stock market now exhibits a split personality. Some stocks and sectors are selling for extremely high valuations compared to many others, presenting investors with considerable risk. We remain cautious and selective.

We believe that a stock’s valuation is a critical indicator to its future risk and return potential. The most common and simplest valuation metric is a stock’s price-to-earnings ratio or P/E. A P/E of 10 tells us a stock’s price level is 10 times its current earnings level while a P/E of 20 tells us a stock’s price level is 20 times its current earnings level, or twice as expensive. Thus, by this metric, stocks with higher P/Es are considered riskier and offer less return opportunity than stocks with lower P/Es.

Of course, comparing P/Es is only part of the analysis of risk and return. A truer measure of value takes into consideration a company’s future earnings level compared to its current earnings level. Businesses that can grow earnings faster over time will merit higher valuations than businesses that cannot. To compensate for the P/E ratio’s shortcoming, investors further evaluate a stock’s P/E ratio to its expected earnings growth rate. This metric is referred to as the PEG ratio.

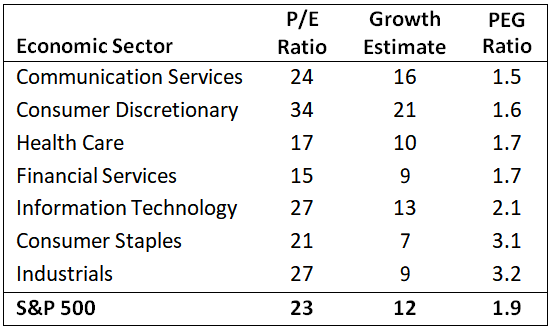

Let’s take a look at how investors are currently sizing up the major sectors of the economy by looking at these various metrics for companies in the S&P 500 Index. In the table below we show the P/E ratio based on 2021 expected earnings, the estimate for long-term earnings growth and

the resulting PEG ratio for each respective sector and the S&P 500 Index as a whole. The table is sorted from lowest PEG ratio to highest PEG ratio. This analysis is useful because it tells us what other investors are expecting and helps guide our thoughts on the stock market’s underlying risk and return opportunities.

To interpret, we will start near the bottom with the Consumer Staples sector which appears unattractive today. It is selling for a P/E of 21, which is historically high, and its long-term earnings growth is expected to be 7%, which is comparatively low. This results in a PEG ratio of 3.2, nearly the most expensive sector on the list, and one

with the lowest growth prospects. Without further analysis, the Consumer Staples sector appears to have more risk and less return opportunity than other sectors. Contrary to this, the Health Care sector appears attractive. Its P/E is 17, which is historically reasonable, and its long-term earnings growth is expected to be a healthy 10%. This results in a PEG ratio of 1.7. Without further analysis, the Health Care sector appears to have less risk and more return opportunity than most other sectors.

In our search for stock ideas, we routinely screen for companies that have historically grown their earnings faster and more consistently than the overall economy. Our goal is to invest in companies that we believe can achieve that result over time, yet to invest in them prudently. Like most investors, we want to own companies with the most growth for the least price. Clearly an art more than a science. To do this we focus our effort on the companies with expectations that seem to us most reasonable and whose results are likely to be achieved or surpassed, while bypassing those companies with the highest expectations and whose results are more likely to disappoint. Insight client portfolios have been structured prudently with these principles in mind.

The many days of 2020 provided uncommon opportunities for us to meaningfully share the investment, administrative and interpersonal experiences we have gained throughout our long careers. I am thankful to have such tenured colleagues.

The Insight team is grateful for the relationships we have with our clients and friends, which we believe have been strengthened during this “virus crisis” – a welcomed outcome.

We wish you and yours a healthy, happy and less eventful 2021!

INSIGHT INVESTMENT COUNSEL