Dear Clients and Friends of Insight,

What a fantastic year it was for stock investors! Globally, nearly all stock markets rose 20% or more. In the U.S., the major market indices advanced some 30%, setting records throughout the year. Plus, our market seems poised to continue advancing into 2020. Perhaps this was the market’s way of saying “welcome to the Twenties!”. Could the market be foretelling a roaring future? Though the U.S. just recorded its first ever decade without a recession, it is unlikely that the economy can continue this slow, uninterrupted growth while stocks roar ahead, unchecked for the whole decade.

That said, the future burns brightly for us, both personally and financially. Our amazing, world- class economy will continue to invent, transform and grow – perhaps more so than at any time in modern history. Our lives and the lives of our children and grandchildren will improve in unimaginable ways. Our capital markets will provide abundant opportunities for individuals and companies alike to richly benefit as this future unfolds. How different life will be when we welcome in the Thirties.

For fun and perhaps some useful insights, let’s compare today’s stock market to those of the early 1980s and the early 2000s. Entering the 1980s, our economy remained mired with high inflation, persistent recessions, and dependence on OPEC oil. In the early 2000s, we were fighting terrorism and recovering from the dot-com crash and grueling bear market that followed. Specifically, we have compared the largest 20 companies comprising the S&P 500 Index for these eras versus today. Although this is only 20 stocks, they represent a very large share of corporate sales and profits and provide us with useful, though not necessarily predictive, views of our ever-changing economy.

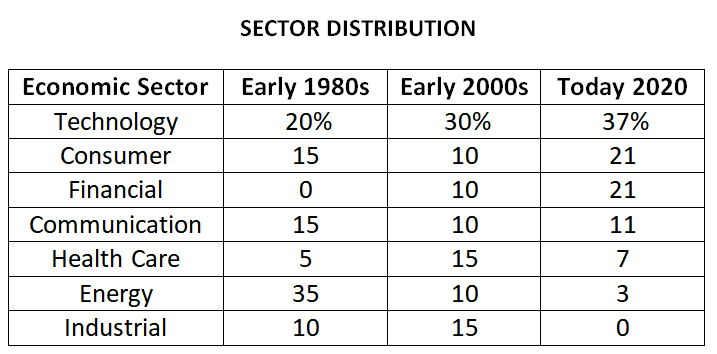

Let’s start with a review of the relative importance of each major sector of our economy, as represented by the top 20 group. Here we show each sector’s approximate share of the group’s total market capitalization for

each period, and where they stand today. Notice the change over time in each sector’s relative importance. To highlight just two: Energy has declined from about 35% of the group’s share in the early 1980s to just 3% now, while Financials account for about 21% of the group now, yet in the early 1980s they had no representation.

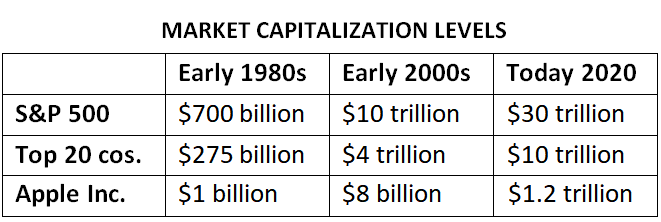

As interesting as these trends are, what is truly astounding is the sheer growth in the stock market over these four decades since the advent of the personal computer. In the next table we track the market capitalization levels for the S&P 500 as well the top 20 companies and Apple for each period. Between the early 1980s and today, the S&P 500’s market capitalization increased from about $700 billion to nearly $30 trillion. That is an increase of about 4,000%! Similarly, the group of 20 bell-weather companies saw its market capitalization increase from about $275 billion to about $10 trillion, well over 3,000%! These stock market gains resulted directly from the achievements of our country’s amazing, world-class companies. Apple is a premier example.

From its initial public offering on December 12, 1980, it has grown to become the most richly capitalized company in the U.S. today. With over $1.2 trillion in market value it has far surpassed the S&P 500’s entire value from the early 1980s. This is truly astounding!

Back to 2019. Insight had a wonderful year, too. Many of our stock selections posted excellent results and handily outperformed the S&P 500 Index, while only a few of our selections posted disappointing results. Thus, client portfolios performed exceedingly well. Our business experienced solid growth too. We welcomed several new clients through referrals from current clients and friends, and several clients contributed additional assets to their portfolios. Through this combination, our assets under management grew by about 25%.

Thank you all very much for your continued confidence in our organization. I would like to especially thank my team for their hard work and professionalism. They are truly committed to our culture of superior client care.

Happy New Year and welcome to the Twenties!

INSIGHT INVESTMENT COUNSEL