Dear Clients and Friends of Insight,

Our letters usually address what is most important within the macro environment – how it will likely impact investors generally, what our overall investment strategy is in response, and how client portfolios will likely perform. We put most of our emphasis on our stock investments (owned for growth in both capital and income) rather than our bond holdings (owned for stable capital and fixed income). However, in today’s unprecedented conditions, the bond market is the most essential aspect of the macro environment for us to interpret. The investment decisions of major global bond investors over the coming years will have a material impact on the performance of both bond and stock investments.

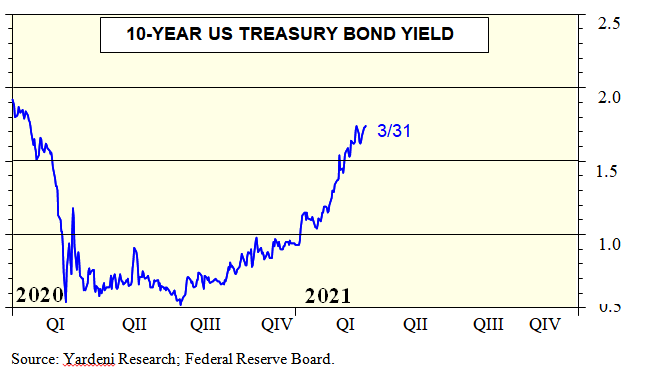

Prior to the pandemic we were enjoying a relatively stable, historically long, economic expansion. The economy was growing, slowly, with our gross domestic product (GDP) advancing at about 2% per year, on average. With low growth, indicators of inflation remained low and below the Federal Reserve’s policy target of 2%. As a result, interest rates continued their long journey lower, eventually oscillating around 2%, as measured by the 10-year U.S. Treasury yield. In hindsight, this was a predictable environment for both stock and bond investors, though investors expected returns to be lower than historical levels. Wall Street referred to this era as “Lower for Longer”. Lower growth, lower inflation, lower interest rates and lower returns for a long time.

The pandemic and the response from governments altered that paradigm. The resulting changes in human behavior, either voluntarily or by mandate, have unquestionably affected the demand and supply of all goods and services. These affects, some of which will prove temporary, have not been felt uniformly across the economy. The economy will need time to sort out and adjust to these shocks to demand and supply. Meanwhile, stimulative monetary and fiscal policies have been rapid, unprecedented in size, and ongoing. Unfortunately, these policies have been broad- based and uniform (read something for everyone, everywhere), rather than carefully targeted to each economic predicament.

These changes to our system have brought about a new paradigm. Our economy is now extremely strong and is gaining momentum. Analysts continue to raise their growth estimates. For this year, GDP is expected to grow near 6% while next year might bring another 4% or more. Our consumers, after a year of staying home, now have large amounts of disposable income and are ramping up their demand for most things. Our producers, with their various supply chain constraints, now face higher costs for labor, materials and transportation, as they all compete to expand supply to meet these needs.

History reminds us and the laws of supply and demand warn us that a dangerous situation is brewing. Too much money chasing too few goods will lead to rising prices, and possibly result in an expectation for a continual rise in future inflation – the demon for bond investors.

Due to the nature of these disruptions, the resulting imbalances between supply and demand will not show up uniformly across the economy. As a result, the robust sectors of the economy will experience more inflationary pressure while the slack sectors may face deflationary pressure.

Thus, headline government statistics may not offer investors a “true” view of the economy’s underlying price stability and trend.

Meanwhile, the Federal Reserve has spoken. They believe the economy is far from fully recovered and is still susceptible to harm, and they are determined to continue their “avoid-another-crisis” policy stance. The Fed has stated that they are committed to these policies even if inflation exceeds 2% for an extended period. Their rationale is that our economy has the capacity to absorb additional inflation because our inflation rate remained below 2% for so many years during our “Lower for Longer” era.

We will not know for quite some time how these upcoming economic statistics will be interpreted by investors. This conflict of fueling the economy’s recovery at the risk of igniting inflation has investors increasingly anxious. This is evident with the rise in interest rates over the last several months as investors are now requiring higher income payments on their bonds to compensate them for the risk of higher inflation.

This inflation risk is especially acute for those large global investors such as pension plans, insurance companies, sovereign funds, foundations and wealthy families, all who routinely invest trillions of dollars in bonds. These investors rely on their bonds’ fixed income payments for current and future obligations and aspirations. As expenses rise due to inflation, the investors’ purchasing power declines and they are faced with potentially large funding shortfalls. This is a primary reason why bond prices decline when interest rates rise and illustrates to investors the true meaning of a negative return!

Bond prices have already declined this year dragging the Barclays Aggregate Bond Index down 3.4%. This may be just the beginning of negative returns for bond investors. While we watch this conflict play out, we believe clients will be best served by a bond strategy that remains focused on safety of principal and exhibits extreme patience. New commitments to bonds should be delayed until we have a better understanding of the inflation risks ahead. As such, cash positions in portfolios will likely be higher than usual.

INSIGHT INVESTMENT COUNSEL