Dear Clients and Friends of Insight,

Just a few short months ago investors and consumers were feeling good, and their expectations were running high. Stock and bond returns were positive in 2024; inflation and interest rates were continuing to fall with the expectation of more declines to come; corporations reported strong fourth quarter results that generally exceeded analysts’ revenue and earnings expectations; and the economy was in the early stages of a strong technology-driven investment and productivity boom. Wall Street strategists were on board, predicting another strong stock market in 2025. Their

consensus forecast was for a 13% rise in the S&P 500 Index!

Just a few short weeks later, though, the mood on Wall Street and Main Street changed noticeably. Key economic indicators, such as employment levels, business spending and personal consumption were softening. Expectations for the economy’s growth were beginning to diminish, and the

perceived odds of an upcoming recession were growing once again. Yet, stubbornly, price inflation was reported higher and, worse than that, the expectation for future inflation was reported higher as well. This put upward pressure on interest rates, which is a strong headwind to an already slowing and perhaps stagnating economy. Adding to these typical macroeconomic uncertainties are the atypical fiscal policy uncertainties swirling through the government sector. Thus, as recent opinion polls confirm, consumer and business sentiment has eroded to multi-year lows. Stock prices have wobbled in response to this shift in sentiment, but as of now the damage has been modest, especially for conservative investors. By example, the Dow Jones Industrial Average of blue- chip stocks declined 9% from its recent high in late 2024 to its low reached on March 13th, while the S&P 500 Index of large, well-established companies similarly declined 10%. We are pleased to report that Insight’s typical stock portfolio maintained its value slightly better during this mild correction.

As one would expect, these drawdowns from recent highs have been greater for riskier stocks, and for those with the greatest expectations for future growth. By example, the technology-heavy NASDAQ Index declined 14% from its recent high to its low reached on March 13th , while the S&P 600 Index of smaller, less-established companies similarly declined an even greater 19%.

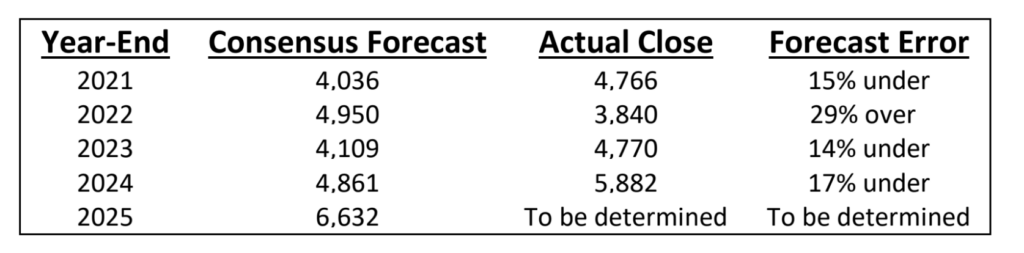

Not surprisingly, Wall Street strategists recently began lowering their year-end 2025 market forecasts as they realized that these forecasts from the beginning of the year are now quite stale and at risk of being markedly too high. These “adjustments” in the consensus view can occur regularly and often so we should be careful not to let them disrupt our long-term investment decisions without thoughtful deliberation. In the nearby table we show Wall Street’s Consensus Forecast for the year- end price of the S&P 500 Index made at the beginning of each year for the years 2021-2024, including 2025. We compared this to the Actual Close of each year, which results in the Forecast Error for each period. As you can see, the professionals were routinely wrong by a wide margin during these last four years.

The market’s recent behavior, driven by a broad reversal in investor sentiment, reminds us once again that the emotions of fear and greed often influence stock prices in the near-term more than business results do. Trying to predict which direction stocks might move next, and for what reason, is usually fruitless and can be an expensive hobby.

We believe our clients’ portfolios are appropriately positioned for the uncertain times ahead, whether that be a mild recession, continued modest growth, or somewhere in between. Our stock holdings predominantly pay healthy dividends which collectively grow faster than inflation, and our bond holdings are structured defensively with shorter maturities to minimize interest rate risk. And of course, all investment selections, upon serious and continuous scrutiny, meet our high standards of financial soundness and strong, dependable profitability.