Dear Clients and Friends of Insight,

We began the new year with the consensus view from market participants and strategists that our economy would slow down from 2.6% growth in the fourth quarter. It would eventually turn negative in 2023, leaving the economy in a “hard landing” recession. Forecasts for Gross Domestic Product for the year were clustered between 0% and 1%. Inflation was to continue moderating, averaging around 3% for the entire year. Though with much less agreement, stock prices were likely to oscillate throughout, but finish the year between 2% and 10% higher, excluding dividends – a helpful gain to make up for last year’s losses.

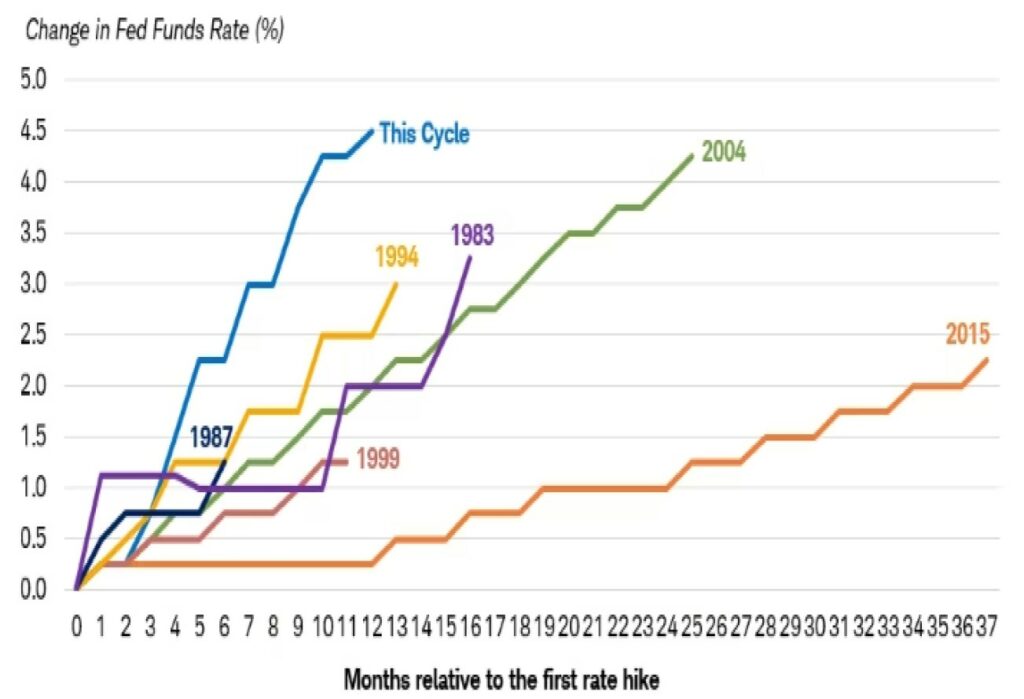

So far, the consensus view of the broad economy is off the mark. The first quarter witnessed stronger growth, likely north of 3%, as consumer spending grew 5% and home sales continued to advance. Inflation has moderated a bit, but it is still a lofty 6% or so. Hence the Federal Reserve Board, continuing with their determination to slow the economy to subdue inflation, raised the Fed Funds Rate another 0.25% at their latest meeting. Though this increase was smaller than prior hikes, it continues the Fed’s extreme tightening posture. As this graphic indicates, the speed and magnitude of the Fed’s action this cycle represents the most aggressive tightening of monetary policy in the last 30 years.

As is well known, it takes time for the economy to adjust to a change in monetary policy. Especially when the reversal between loose and tight policy is of this speed and magnitude. The economy’s participants, whether they are spenders, borrowers, lenders, investors, corporate chiefs, entrepreneurs or philanthropists, need to recalibrate their decisions. This does not occur all at once or uniformly across our diverse economy. This is why Chairman Powell continues to clearly communicate the Fed’s policy stance toward still higher rates. Yet what can occur quite suddenly and uniformly is a drop in stock or bond prices when bad news strikes, and the emotions of investors turn to fear. Remember, investors are forward-looking and will incorporate new information into future expectations, often quite hastily whether correct or not. As such, many of last year’s big market declines were a result of this recalibration.

Recent news has focused on some regional bank failures, causing investors to worry whether this could be the precursor to operating challenges for other banks or even the entire financial sector. Furthermore, this may be an indication of what lies ahead for other sectors and our economy at large: bankruptcies, repossessions and defaults, including by the U.S. government.

Clearly there are many economic transactions still to be negotiated in this now stingier and higher interest rate environment. Even though this new paradigm has been expected for several years, some individuals, businesses and governments have not properly prepared for it and will be financially challenged in the months and years ahead. But we believe those most challenged by this are outliers and not representative of the general level of risk in the economy or the stock and bond markets. Nonetheless, we are comforted knowing that our security selection process for both stocks and bonds is focused on owning securities of the most financially strong businesses – a sound risk management principle for conservative investors.

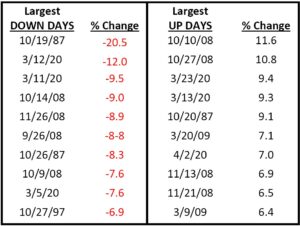

To illustrate the extent to which emotions can influence investor behavior, we catalogued the ten largest daily percentage advances and declines in the stock market, as measured by the S&P 500. As you can see, investors can respond quickly, and often irrationally when confronted with unexpected news. While the daily price changes at the “stock market” level can belarge when unexpected news arrives, they can be even larger at the “sector” and “industry” levels, and even more pronounced at the “company” level. This has been quite evident in the banking industry and financial services sector these last few weeks. That is why we diversify your investments across sectors, industries and companies – another sound risk management principle for conservative investors.

The current economic, and by nature, political environment will continue to present challenging conditions for many sectors and industries as many companies are pressured with operational and regulatory headwinds. This will undoubtedly lead to economic and corporate news reports that are difficult to interpret and likely to confuse the investment outlook. Some of these reports may prompt unexpected and severe reactions from investors. It would be wise to expect some uncomfortable days. We believe our client portfolios are prepared for these possibilities. As always, we look forward to sharing our views in our discussions with you throughout the year.