Dear Clients and Friends of Insight,

Considering the numerous challenges investors faced in the first quarter, we are pleased to report that Insight’s client portfolio values held up quite well, which we’ll share below.

First, here is a quick recap of the key challenges from the first quarter. Economic growth around the globe has slowed from the post-Covid rebound. The Federal Reserve, along with other major central banks, finally began raising interest rates. Inflationary pressures continue as supply and demand remain out of balance. Wages are rising, too, but not enough to overcome the rapid rise in food, energy and housing costs. The consumer’s disposable income is being squeezed. These higher labor costs are also weighing down business profits. This might be leading to a wage-price inflation spiral where higher wages push up prices, which push wages up again, and so on. The robust levels of consumer and business confidence from last year have waned. The prospect of a recession or extended period of stagflation has increased. Investor sentiment turned negative. Then, to add considerably to the world’s stress and uncertainty, Russia is invading Ukraine.

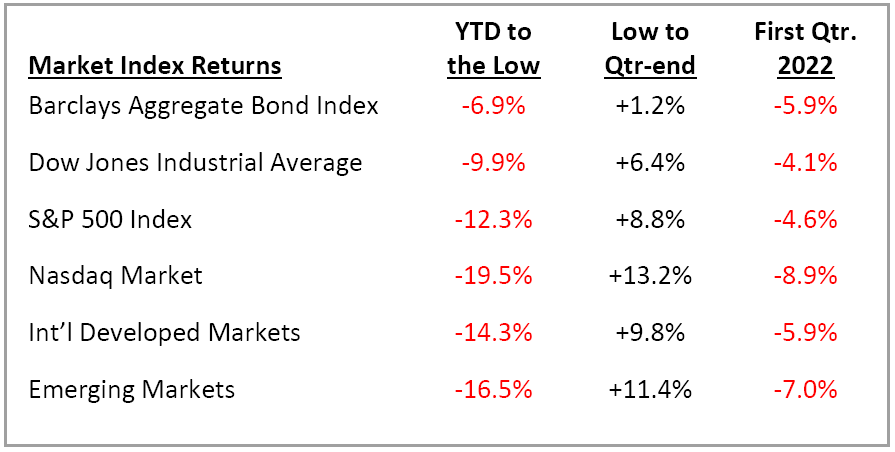

These challenges pulled the major stock and bond indexes into negative territory for most of the year. Although the markets have recovered some of their lost ground, most investors closed the quarter with losses from both their stock and bond holdings. In the nearby table we show the returns for major market indexes. We have reported the returns for three time periods: (1)from the beginning of the year to each index’s respective “low”; (2) the rebound from the indexes’ low to the quarter’s end; and (3) for the entire first quarter.

As you can see, and as we have been expecting, bond investors suffered a significant loss as interest rates have started their ascent. By example, the 10-year Treasury yield, which was at 1.5% to start the year, leapt to nearly 2.5% of late. This yield is still far below current expectations for future inflation levels, leaving bond investors with the prospect of continuing negative real returns! We believe this trend of rising interest rates is likely to continue for quite some time and will be a major hinderance to bond returns. To mitigate this risk, we are maintaining a much shorter bond maturity profile, while also allowing cash balances to build as we wait patiently for a higher and more stable interest rate level. Though our clients’ bond allocations were down in value, our conservative posture helped buffer this decline.

Switching to the stock indexes, the Dow Jones Industrial Average experienced the mildest of corrections. Many of these bell weather companies attracted investor interest for their stability and dividend income. Although the Dow had dropped over 9% at its low in early March, this was considerably milder than the tech-heavy Nasdaq, which had a correction of nearly 20%! Similarly, international developed and emerging markets fell hard. Although stocks bounced handsomely from their lows in later March, it was not strong enough to recover the year’s earlier decline.

The market’s recent behavior should remind us of the age-old investment adage that you win by not losing. During this turbulent first quarter our clients’ stock selections did just that. They declined by a modest 2-3%!

We firmly believe that long-run success accrues to investors who can steer clear of large setbacks and stay committed to their long-term investment plan. To help us accomplish this outcome we apply the following prudent framework:

- Investment strategy guided by our contrarian thinking and experience

- Security selection focused on quality, consistency and profitability factors

- Buy and sell decisions formulated around our disciplined valuation work

Our current challenges notwithstanding, the future is bright with opportunities. By example, last year there were more than 17,000 venture capital transactions in the U.S. alone, a 40% increase from 2020! Not all of these ventures will succeed, but many will, and the economy will continue to adapt and grow, leading to higher income and ultimately, higher stock prices. Just not in a straight line. We believe our framework will continue to serve our clients well in an increasingly uncertain world. We look forward to our upcoming discussions with all of you. In the meantime, please call us with any questions or concerns.