Dear Clients and Friends of Insight,

The goal with our letters is to provide concise commentary on current events, how they may be affecting portfolio returns, and what investment implications there are for both the shorter- and longer-term horizon. We regularly include important information to remind us all of key investment principles that have been tested through both good and bad times. These are principles upon which we rely to manage our clients’ assets prudently and in line with their individual needs. We communicate this frequently and sometimes we are intentionally repetitive because the principles are so important to long-term investment success. Our guiding principle:

Our investment selection process is designed to identify and own financially sound, well-established businesses that have demonstrated considerable earning power, and usually pay dividends or have the capacity to pay them. Our criteria are to purchase these businesses at reasonable prices and own them for many years, allowing for returns to compound tax-efficiently over time.

In our April letter, we counseled that “market indexes, and investors who invest indiscriminately in the popular index products, may experience disappointing results. Their returns will more likely move in unison with other investors.” We continued, “there remains compelling reward for investors who own carefully chosen individual stocks,” with “our customary qualities of financial soundness, reasonable valuations, and the ability to strengthen their earning power.”

In July we shared our examination that “fully 52% of our most commonly owned positions are judged to be both the safest and the most financially sound of businesses” as measured by Value Line. This compared to just 15% for the S&P 500! We then cautioned that when this bull market ends “it will be an unpleasant time for stock investors. Yet those investors who followed an investment process focused on the highest quality of battle-tested businesses can more confidently stay their course and emotionally endure the contraction”.

For this letter we provide another example of how important it is for the preservation-minded investor to have a deliberate selection process focused on owning individual stocks, rather than indiscriminately investing in popular indexes. We contrast the wisdom of this statement with our industry’s prevailing recommendation to diversify broadly across global markets. Yes, it can make sense to invest globally; however, investors must be aware of the consequences of doing so.

Our focus now is on economic sectors whose importance and size vary by region and country around the globe. You might be surprised that this variability is considerable. A few comparisons based on the Morgan Stanley Capital International (MSCI) global market Indexes will illustrate this degree of variability. For example, the U.S. stock market’s largest sector is Technology which comprises roughly 25% of the Index, while its smallest sector is Telecommunications for only 2% of the Index. For Japan’s stock market, the largest sector is Consumer Discretionary which accounts for about 21% of the Index, while its smallest sector is Energy for 1% of the Index. Continuing to Asia-Pacific (ex-Japan), its largest is Financials with 30% and its smallest is Technology with 1%.

Whereas Europe’s largest is Financials with 17% and smallest is Telecommunications with 4%, while Emerging Markets is Financial at 27% and Health Care with only 3%.

Here is an example of why these differences in sector exposure across countries might impact an equity portfolio that is invested in global indexes. When we reduce U.S. stock exposure, we lower Technology exposure since it is the largest sector for the U.S. If instead we invest in Asia-Pacific (ex-Japan), we increase exposure to Financials, its largest sector. Thus, diversifying investments across global markets could change a portfolio’s exposure to economic sectors which could be unintentional, and worse, expose the investor to more risk than is suitable for their needs.

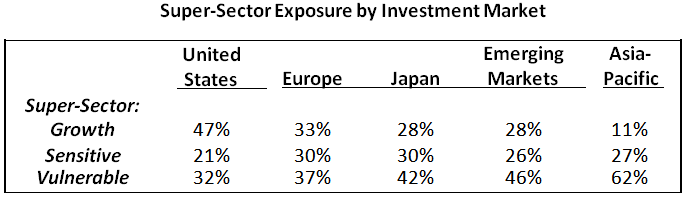

To further emphasize the importance of how a portfolio is allocated globally we grouped the economic sectors into three “Super-Sectors”. We believe this perspective provides a better indicator of how a portfolio might perform in various economic environments. We have called these three Super-Sectors Growth, Sensitive and Vulnerable. The Growth category includes companies that will likely grow regardless of the overall health of the economy and contains the Technology, Health Care and Consumer Staples sectors. The Sensitive category is comprised of companies whose profits are somewhat affected by the economy. These sectors are Industrials, Energy, Utilities, and Telecommunications. The Vulnerable category includes companies whose profitability depends on a healthy economy. These sectors are Consumer Discretionary, Financials, Real Estate, and Basic Materials.

In this table we show the aggregate exposure to our three super- sectors for the major investment markets around the world. Notice the large variation in exposure to the Growth and Vulnerable sectors.

It seems reasonable to expect portfolios with greater exposure to Vulnerable sectors and less exposure to Growth sectors to struggle when economies falter or worse. Hence, we believe these portfolios have a greater absolute risk of decline. Similarly, it seems reasonable to expect portfolios with more exposure to Growth sectors and less exposure to Vulnerable sectors to hold up better, with less absolute risk.

Of course, there are many dimensions to investing and numerous analyses to consider. However, viewing a portfolio through this super-sector lens provides interesting clues toward understanding portfolio behavior. And, it supports our belief that the likelihood of investment success is greatly enhanced by investing in individual companies that are analyzed and selected on their own merits.

Thank you for your continued confidence in our guidance.

INSIGHT INVESTMENT COUNSEL